Analysis: WWE Reports Record Revenue, Executives Comment On Ronda Rousey

A detailed review of all the news learned as WWE released its fourth quarter earnings report and commented on Ronda Rousey and Mixed Match Challenge

Revenue, OIBDA and Net Income context

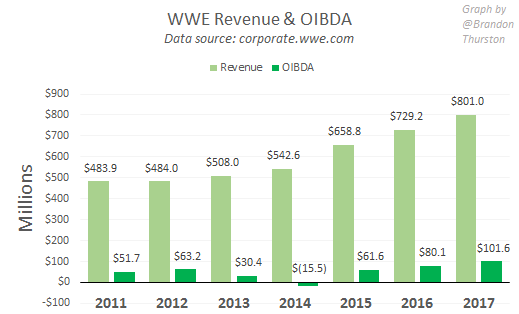

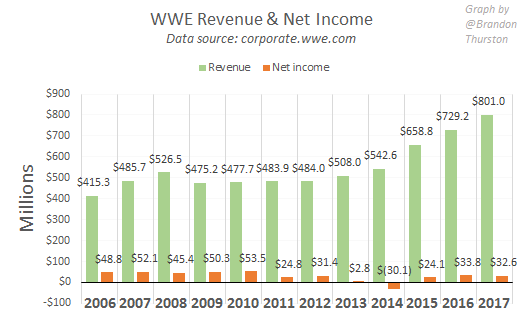

The industry leader in pro wrestling announced its Q4 and full year 2017 earnings today, reporting a record $801 million in revenue for the year, the highest in company history.

OIBDA, a way of measuring profit, was at $101.6 million. However adjusted OIBDA (which excludes certain expenses WWE feels would impact comparability), was also at a record high, at $111.9 million for the year. Net income, another measure of profit, was reported at $32.6 million, comparable to 2016 and somewhat below that of prior years.

WWE Network subscriber update

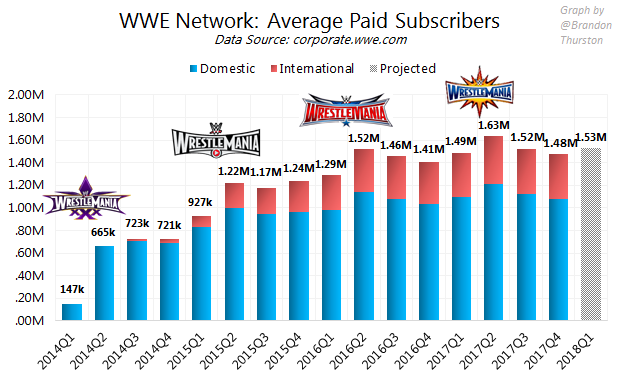

Average paid subscribers to the WWE Network throughout Q4 were at 1,480,000 million, within the company’s previous projection. That’s down 3% from Q3 (1,520,000), which is similar to the drop from Q3 to Q4 in 2016 (1,460,000 in Q3 2016 to 1,410,000 in Q4 2016).

The company projects average paid subscribers for Q1 2018 at 1,530,000, which would be a 3% increase from the previous quarter. Q1 results are expected to be reported in May.

While WWE hinted in the past it’s thinking about offering multiple tiers of the WWE Network, perhaps including a premium tier, no additional news on that was revealed.

Comments on Ronda Rousey

The news of Ronda Rousey debuting with WWE was brought up on the conference call.

“We’re finalizing details of the deal [with Rousey] now,” Paul Levesque, said, seeming to imply the deal with the former UFC champion isn’t done yet despite reports that she has signed with the company “full-time”.

It’s unclear what kind of schedule Rousey will take on with the company. Levesque, whose executive title is Vice President of Talent, Live Events & Creative, however reassured analysts and investors that Rousey is with WWE for the long-term.

“Just to be clear, it’s a multi-year deal. We are her #1 focus and goal,” he added.

“As [Rousey] has stated, she wants to be ingrained in the fabric of WWE. This is not a journey into something quick where she wants to come in and do a few events. This is her life now… She wants to be with us for a long time.”

No changes in Vince’s role, contrary to 205 Live situation

Vince McMahon was asked whether the XFL would affect his role in the company and specifically whether Vince’s recent stock sale of nearly $100 million would be enough to fund the relaunching football league. Investors may be wondering whether Vince will need to sell more stock, of which he still holds 32 million shares (today valued at about $1 billion).

Vince, perhaps not fully prepared for the question, gave an answer that wasn’t very clear:

“Well I don’t want to speak to XFL in terms of obviously — going forward [it’s] going to take more than what the original idea — but what we announced as far as investment’s — what I announced in terms of investment.”

He then moved on to addressing the same analyst’s question about whether the relaunch would affect his day-to-day or long-term role in WWE.

“As far management’s concerned, my role won’t change at all,” the chairman and CEO said, echoing statements he made during the press conference held last month, announcing the re-launch of the XFL in 2020. “We’re going to have a separate management for XFL. So I don’t see any significant or, if any changes, on what I do on a day-to-day basis.”

This is contrary to a report from PWInsider saying Vince has already handed the creative reins for 205 Live off to Levesque. Another report in the Wrestling Observer Newsletter says Levesque will “gain a lot more control” due to Vince’s XFL duties.

Facebook Watch comments (time watched, engagement)

Executives touted the success of the Mixed Match Challenge program, which is airing matches of a mixed tag team tournament on Facebook Watch every Tuesday night after SmackDown.

Chief Marketing Officer Michelle Wilson noted that the program has gotten 6 million views and 12 million minutes of watch time so far. (It wasn’t clear if these numbers counted just the first three episodes or included the fourth episode that aired this week).

This would imply the 22- to 24-minute episodes are played for about 2 minutes per view. One analyst pointed out Facebook management says average viewing time on Facebook Watch is 17 minutes.

Chief Financial Officer George Barrios said on the question of watch time for Mixed Match Challenge:

“[Facebook] has data that we don’t have, so I’d like to stay out of the comparison. I will say what we’ve seen, because we can see content– how it does on YouTube, Facebook and other platforms. I would say we’ve seen a marked improvement in the [Facebook] Watch tab for WWE content, the time spent viewing versus pre-Watch tab.”

JPMorgan published a report on Wednesday, showing total view counts for Mixed Match Challenge are about 2 million per episode. That’s a fraction of other Facebook Watch programs like Returning The Favor and Tom vs. Time. But the number of comments on episodes of MMC are multiple times that of the aforementioned other programs. The third episode of MMC had 63,000 comments, while the third episode of Returning The Favor, Ball In The Family and Tom vs. Time had just 3600, 2500 and 4500 comments, respectively.

Barrios on social media skepticism

While it only makes up a small amount of the company’s overall revenue, WWE’s Digital Media segment had its biggest quarter yet. The segment, which is largely comprised of money from YouTube ad revenue, recorded revenues of $12.8 million for Q4 and $34.5 million for the year, with OIBDA of $5.9 million on the quarter and $10.2 million on the year.

“Seven or eight years ago [digital media] was only a marketing channel. Today it’s an incredibly powerful channel for us,” Barrios said.

While WWE pushes it’s social media presence hard throughout its programming, many often wonder how that presence will ever translate into money for the company beyond being a marketing platform for its various brands.

“[Digital media is] not where traditional TV is but [the monetization is] coming,” Barrios contended.

The CFO drew back on media history:

[A]t the advent of cable TV, all around the world people said the same thing: ‘Oh yeah, there’s a lot of stuff out there. People are watching but there’s no money.’ And today it’s the engine, or it was the engine that drove the media industry for a long time. So there’s a long history of dollars following eyeballs. We believe that into the future. We’re starting to see it. Is it where traditional TV is? No. Do we know where it’ll end up? No. Do we think it’ll continue to grow? We do.

Barrios and Wilson promoted to co-presidents, added to BOD

Along with its quarterly financial documents, WWE also issued a press release announcing the promotion of both Barrios and Wilson, “[i]n recognition of their contributions to four years of record revenues and the successful transformation to a multiplatform business model.”

Barrios and Wilson are now co-presidents of the company. It’s not clear whether this means any changes in their day-to-day duties. The two executives have been essentially the #2 and #3 faces for WWE on the business side for several years.

The press release also announced they have been appointed to the company’s Board of Directors.

Financial reporting changes

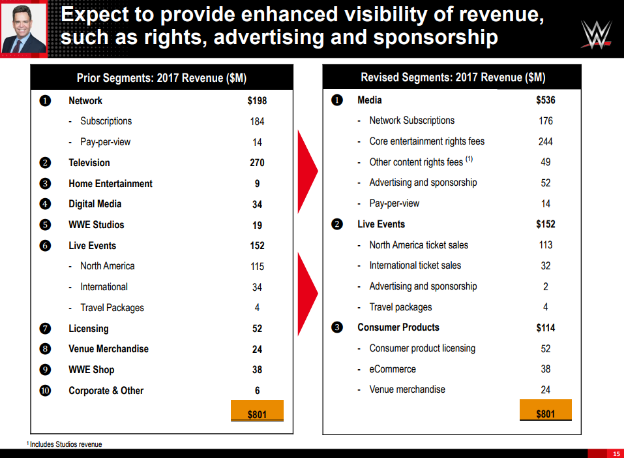

The company revealed it’s reorganizing the way it reports its financial information. Rather than ten segments, with a few broken down into some sub-segments, starting with the next quarterly report, there will be three segments that will each be broken into several sub-segments.

Source: WWE Investor Presentation, Feb. 8, 2018 (p. 15)

Barrios explained the new reporting will break out TV rights deals, separating RAW and SmackDown’s TV rights from that of Total Divas and Miz & Mrs., for example.

However it appears WWE Studios will also be lumped it with those “Other content rights fees” from reality shows, perhaps to obscure the company’s movie business’s regular money losses.

The company will also modify its definition of the non-GAAP measure, adjusted OIBDA.

Investors will learn just how WWE presents this information when the Q1 report is released, likely in early May.

Stock price reaction

The stock market reacted positively to the earnings report. WWE shares are up to nearly $35 as of this writing on a day when major indexes were down.

Shares have increased sharply in recent months due to optimism about WWE getting a favorable new round of TV rights contracts. The company’s US television deal, currently held by USA Network parent NBCUniversal, is still scheduled to be announced sometime between May and September of this year.

Follow Brandon on Twitter at @BrandonThurston. He co-hosts Wrestlenomics Radio, a weekly podcast on wrestling business.