Big Wheel Keeps Turning: WWE Q4 and Full Year 2016 Report

Investors were apparently happy with WWE’s 2016 Q4 and full year earning report released Thursday. The stock was up an impressive 9% at the close of the market later that day.

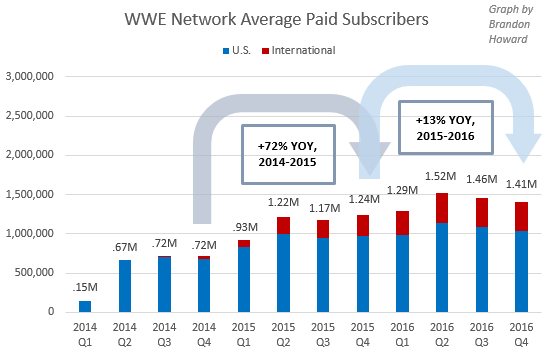

As reported earlier, the WWE Network ended the year with 1,403,000 paid subscribers and an average throughout the quarter of 1,407,000. While they maintained an average of 1.4 million subscribers, customers apparently check in and out a lot. WWE reported there were a total of 1,858,700 gross additions (instances of a subscriber signing up) during the year and 1,672,800 cancellations. The company went beyond the December 31 date that the quarter ends on and reported subscriber numbers as of January 31 of this year as well. As of that date there were 1.50 million paid subscribers. The increase is likely due to Royal Rumble which took place on January 29.

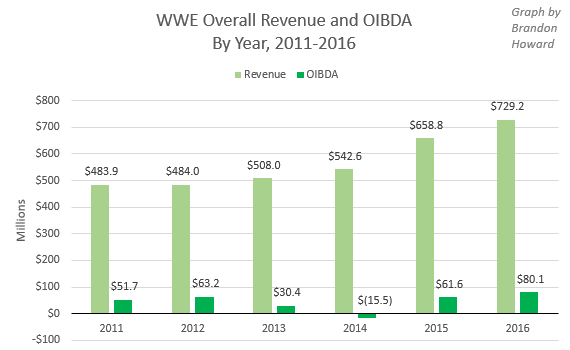

WWE reported a record $729 million in revenue for 2016 and $80 million in OIBDA (profit). WWE held firm to its projections that the company will break its OIBDA record in 2017, predicting it will report $100 million in profits at the end of this year.

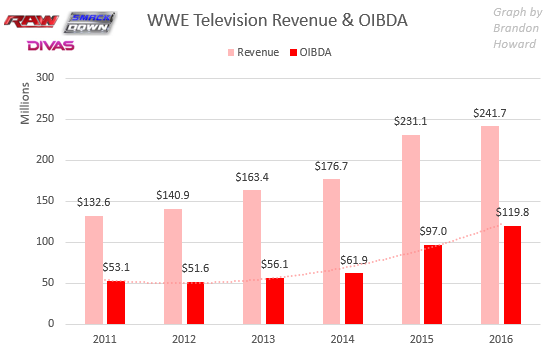

As expected due to contracts that guarantee escalating fees, WWE ended 2016 with a year over year increase in its biggest revenue stream: television rights. The company generated $242 million from TV and $120 in OIBDA.

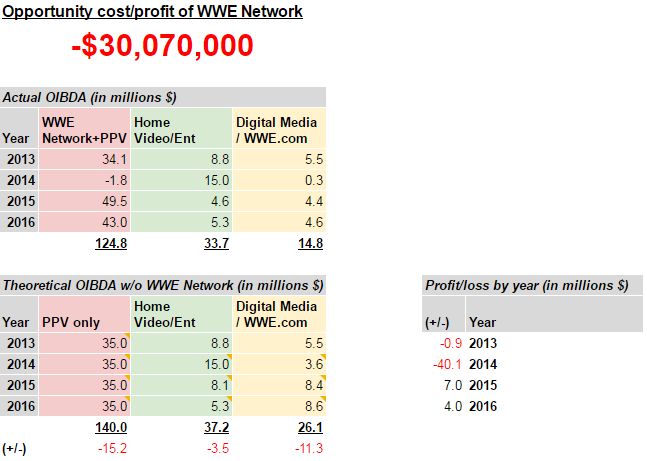

OIBDA on the Network is down slightly from last year. Based on Google data used to predict what pay-per-view buys would be if WWE had never launched the Network, the company would have generated $50.9 in PPV OIBDA this year. Since the Network also cannibalized Home Entertainment (DVD/VOD sales) and Digital Media (which included internet PPV sales), the Network actually needs profits well above what the PPV used to (or would) generate in order to equal the profits of the old model.

Even if the Network’s profits equaled all the cannibalized profits from PPV, Home Entertainment and Digital Media, that’s still not sufficient for the Network to be considered a wise business move; the Network was launched with huge startup costs to the point the Network/PPV segment lost money in 2014. This calculation estimates the Network venture is $55 million to $73 million in the hole. If we’re more generous and estimate WWE would’ve made $35 million in OIBDA in each year 2013 to 2016, the company would now be starting to make back some of the money it lost to the start the Network, but would still be down $30 million at the end of 2016.

The company, which has proven to be able to provide quite accurate projections on its Network numbers, told investors to still expect year-over-year subscriber growth in 2017, “albeit at a lower rate”. WWE has stated in the past it has an ultimate subscriber goal of 3 million. That goal didn’t happen to get a mention in the presentation Thursday.

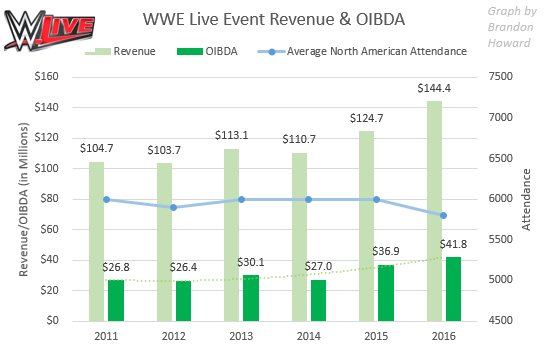

Total live event attendance was up slightly in 2016, with 2,101,800 fans attending main roster WWE shows versus 2,055,000. However there were more events this year: 344 compared to 329 last year. Therefore average attendance was slightly down. Average paid attendance for events in the U.S. and Canada (where 280 events were held) was 5,800 compared to 6,000 last year. Average international attendance on 64 events was 7,500, slightly up from 7,300 in 2015.

While attendance has remained flat over the last several years, revenue and OIBDA have steadily increased.

WWE credited the increase in revenue to higher ticket prices, including those of WrestleMania 32 which alone generated $17.3 million in ticket sales. WrestleMania 31 in 2015 drew a gate of $12.6 million.

The above attendance counts and averages don’t include NXT events, but the revenue and OIBDA figures do. For the first time, WWE revealed some details about NXT attendance. The developmental brand ran 189 events (including the smaller events run frequently throughout Florida) with an total paid attendance of 187,800 and an average ticket price of $37.32. This means NXT shows were responsible for $7 million in revenue (5% of all live event revenue). This is up from 2015 when there were 120 NXT events with a total paid attendance of 92,500 and average ticket prices of $36.71, which comes out to $3.4 million in revenue (3% of all live event revenue).

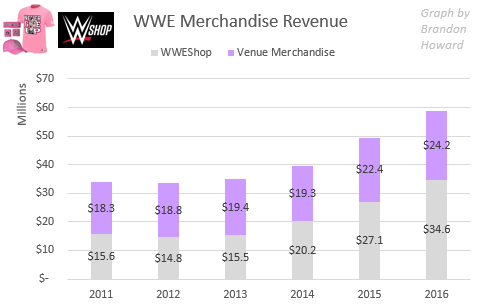

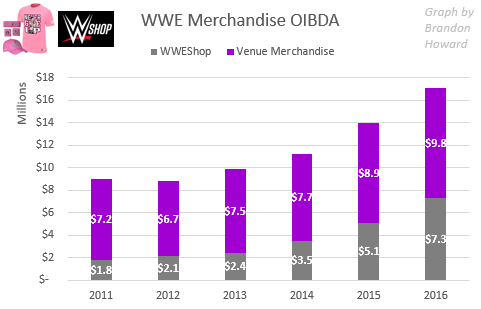

Merchandise financials are significantly up. WWE separately reports merchandise sales at live events (Venue Merchandise) and sales online via WWEShop.com and other online retailers including Amazon.

Are increasingly hardcore fans spending more per capita? Not really. WWE reported venue merchandise sales per capita were up but only by 3%. The company explained WWEShop segment increases are due to an increase in the volume of orders thanks to “additional distribution channels, including in international territories, continued marketing efforts and a broader assortment of products offered”. It sounds as if the growth of WWEShop can be credited to greater access internationally rather than this metric being an indicator of a genuine rise in WWE popularity. In the case of online orders, spending per capita isn’t up strongly. Average revenue per order in 2016 was $44.61, down 3% from 2015.

(Source: WWE Key Performance Indicators)

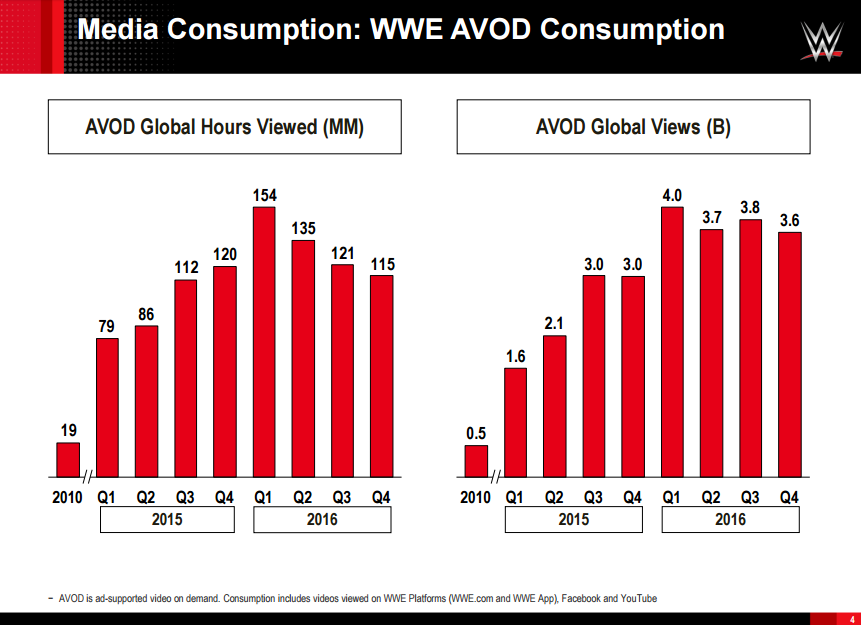

WWE’s once explosive growth on YouTube seems to have matured. Revenue from AVOD (ad-supported video on demand) views is reported under within Digital Media. While AVOD views have grown at a nearly exponential rate over the last few years and now apparently stabilized this year, Digital Media (which also includes sales on WWE.com) has remained a small segment for the company.

CFO George Barrios has publicly held firm to the company’s belief that social media will eventually become a strong revenue driver. “We believe the money will follow the eyeballs,” he said at a presentation in December. “That’s starting to happen.”

In the conference call, as reported earlier, CEO Vince McMahon surprisingly made it clear that the 101,763 attendance figure for WrestleMania 32 in Dallas, Texas, was not a paid number.

Anlaysts seemed interested in WWE’s UK tournament and the possibly weekly show that might follow, whether it be on the WWE Network or distributed with UK TV partner Sky.

Barrios said the WWE Network did see “an uptick in adds” to subscriptions in the UK specifically around the time of the tournament, although he didn’t go into any more detail.

“We could easily morph that into a weekly show. It’s something that we are thinking about,” McMahon said, responding to an analysts asking when to expect a weekly UK wrestling program. “Nothing we have announced yet. Our partners are very interested in that. The tournament and the buzz from the tournament was highly successful in the UK. And there might be other Europeans that might join in the future.”

McMahon responded to a question about WrestleMania, saying this year’s event has more momentum than last year’s, thanks to a lack of injuries like those that occurred leading up to WrestleMania 32.

“Well, let me just say, there is no one talent that makes this big wheel keep on turning,” McMahon said, seeming to want to make it clear that the loss of any one star doesn’t slow down the WWE machine. “As far as momentum is concerned, I think we have more momentum this year than we did last year. And as you mentioned, fewer individuals are injured. So that always gives us a larger talent pool and more players to deal with and more storylines.”

McMahon, spoke more than usual on this conference call. He lauded the brand extension for it allowing the company to be more versatile when it comes to running live events as well as in promoting talent.

“[The brand extension is] working extremely well, exactly like we thought it would.”

McMahon pointed out having separate rosters for RAW and SmackDown freshens things up and gives “more room for more talent to be able to rise to the top. If you have only one show in one with the same – two shows with the same talent, it’s difficult to create new stars because the tendency is just to keep the new larger talent on top all the time. So it allows other stars to be able to climb the ladder of success.”

“And of course the other aspect of that is that SmackDown is now a live television show, television ratings for the SmackDown have been extraordinarily good, much better than previous years. RAW’s rating continues to decline somewhat, much like the NFL ratings.” NFL ratings were down this past season from the previous one.

As McMahon mentioned on the call, WWE’s “big wheel keeps on turning”. The company continues to be a strong business supported strongly by guaranteed TV rights fees. Uncertainty still lies ahead in 2019 when the largest of those contracts are set to expire.

We’ll hear again from McMahon and Barrios on April 3, the day after WrestleMania 33, with another update on Network subscriber numbers.

Follow Brandon on Twitter @adecorativedrop. He can be contacted by email at brandon@fightful.com.