Google Shopping Rankings for WWE Talents for 2016

At WWE live events, there’s a trailer just outside the venue that opens up, loaded with hundreds of T-shirts and accessories. A block away, bootleggers yell that they’ve got shirts too. Inside the building are multiple stands with more merchandise. Before the show starts and right after it ends, the lines can be long: parents and their kids, young adults, shoulder-to-shoulder. One-by-one and slowly, patrons flutter away from the counter with silvery plastic bags branded with the big “W” logo, barely able to keep the contents inside, scampering back to their parents or gaggles of friends.

Most of WWE’s merchandise features a particular talent. Fans enamored with a particular wrestler want to wear a shirt that represents and supports their favorite. Revealing which talents drive the most merchandise isn’t a part of WWE’s regular reporting as a publicly-traded company. We are left to speculate or investigate.

WWE’s public reports tell us how much merchandise revenue the company generates (breaking it down into items sold at venues and those sold on WWEShop.com), but we know little outside of anecdote to tell us who the strongest sellers are. Here we’ll attempt to shed some light on which WWE talents are the top merchandise sellers are by studying Google Shopping searches.

When you hover over the “Superstars” menu option on WWEShop.com, the eight talents whose likenesses appear are John Cena, Roman Reigns, Seth Rollins, Kevin Owens, Dean Ambrose, Enzo Amore & Big Cass, A.J. Styles and Sasha Banks. Halfway decent marketing stands to reason these are roughly the eight strongest sellers of WWE merchandise would be the eight who are featured prominently in this way to potential customers who visit WWE’s merchandise website.

WWEShop.com also allows us to sort by “Best Sellers” but it’s difficult to tell whether the items shown in this view are actually ranked in an order that reflects sales numbers, or whether there are any metrics determining that view at all that are meaningful to trying to deduce which products are selling best. For example, as I write this, the “Bret Hart POP! Vinyl Figure” is the first item listed when you sort by “Best Sellers”. Is that really the top-selling item on WWEShop.com at the moment? Given Bret Hart isn’t currently featured on WWE programming with any regularity, I find that hard to believe.

In the past we’ve studied data from Google searches to consider the interest around WWE pay-per-view events. Besides plain Google webs search trends, we can also look at Google Shopping searches, which is more relevant to this discussion. In case you’re unfamiliar, when you do any search on Google, you can click on the “Shopping” tab belows the subsequent search bar where Google provides results of where you can buy items related to the term you’ve searched for. By comparing Google Shopping trends for WWE talents, it’s plausible we can get a quantitative comparison of which talents are the strongest merchandise sellers.

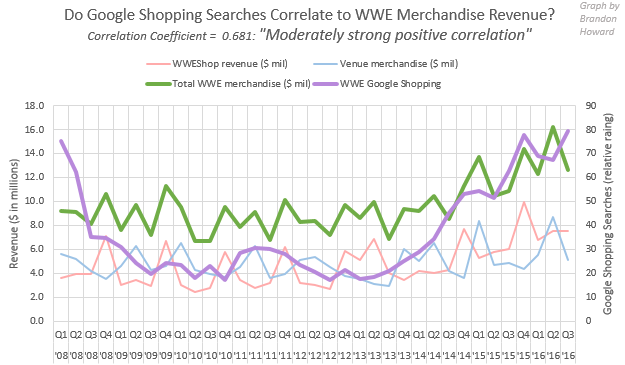

But first, can we be confident these Google Shopping search metrics we’re about to look at correlate to actual WWE merchandise revenue?

Yes. When we extract Google Shopping searches for “WWE” (to include search terms related to it) going all the way back to 2008, we find searches moderately correlate to WWE’s reports of its merchandise revenue. Comparing the two series of metrics produces a correlation coefficient of 0.681, which suggests a moderately strong positive relationship.

In later years the relationship strengthens between searches and WWEShop revenue meanwhile the relationship between searches and venue revenue weakens. The relationship on the whole, however, between searches and total merchandise revenue (WWEShop and venue merchandise revenue combined) strengthens in those later years.

It seems reasonable to imagine top-selling talents for venue merchandise and that of WWEShop could be significantly different. I don’t have any hard evidence to suggest this, but it’s possible John Cena for example might be a very strong seller when it comes to venue merchandise but less strong on WWEShop. Anecdotally, you see a lot of fans wearing John Cena merchandise at venues, especially house shows. Perhaps the type of fan who buys WWE merchandise online, away from the hype of a venue, is more ardent and less likely to be attracted to merchandise of someone like Cena or certain others.

At any rate, given that searches over the last eight years have correlated well to venue merchandise and WWEShop combined, I think it’s reasonable to proceed and consider these data while keeping those caveats in mind.

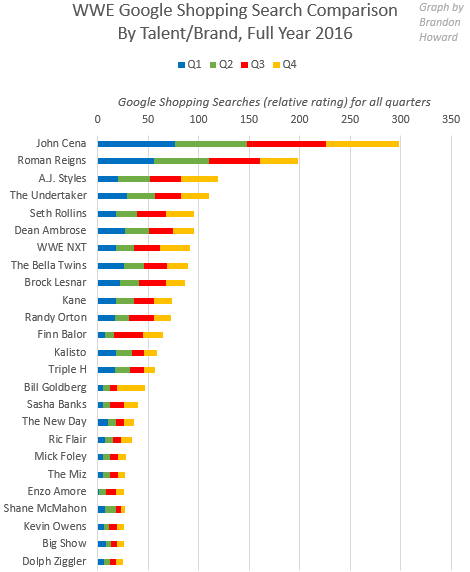

The top 25 talents or brands for Google Shopping searches in 2016 were:

Despite the caveat just mentioned about being wary of a distinction between the composition of venue sales and WWEShop sales, John Cena is the clear #1 on Google Shopping searches. He’s followed by a fair margin by Roman Reigns, who’s well ahead of the rest.

Interestingly, A.J. Styles is already #3 despite being with the company for only one year. Styles was a major star in TNA from 2002 to 2013 until spending 2015 and 2016 in New Japan Pro Wrestling while also being one of the top names on the indies. He debuted with WWE at the Royal Rumble last year on January 20, 2016. You can look at the Google Shopping trends for Styles going back to 2008 and see how shopping searches for him exploded upon his signing to WWE. It’s unclear whether Styles was already such a star in the making in TNA or whether his run in New Japan and on the indies primed him with certain fans which enabled his viability as a top star in WWE.

We might think of Styles as being a talent like Daniel Bryan: one of the best in the world in-ring; relatively small in stature; in good shape but not a bodybuilder physique; at times very good but not particularly known for his promos; and beloved for many years by fans who follow wrestling beyond WWE. Add on that in Styles’ case he has a southern accent, it seemed going into his debut that he’d be a tough sell to Vince McMahon. So what made WWE’s push of Styles so much more quick and committal compared to Daniel Bryan who many perceived as underutilized in WWE?

That graph suggests Styles is already roughly four-times the merchandise draw that Bryan was. Maybe the fact is, compared to Bryan, Styles was a better mover of business metrics, such as merchandise (which these Google Trends suggest).

Self-fulfilling prophecy could be a factor. Styles was given a stronger profile from the moment of his WWE debut, beginning a feud with Chris Jericho. Meanwhile, Bryan’s proper WWE television debut on the other hand was as a part of the original NXT program in 2010 where he was portrayed as a rookie. Or perhaps there’s something simply more marketable about A.J. Styles currently than there was about Daniel Bryan during his time as an active wrestler in WWE.

For as cynical as fans can be toward the arguably insufficent presentation of wrestlers like Daniel Bryan and CM Punk and the arguably excessive presentation of those like John Cena and Roman Reigns, after studying metrics like these, I suspect WWE looks analytics internally which are somewhat reflective of the data we see here and which are used to inform the pushes of those like Reigns and the lack of focus on those like Bryan, which accounts for the “vocal minority” argument espoused by those including Vince McMahon to explain away (still insufficiently in my opinion) crowd reactions like those at Royal Rumble 2015 when babyface Reigns was booed to victory.

Other interesting notes coming out of this: New Day is lower than expected in light of Big E’s claim on Twitter that New Day was WWE’s top merchandise seller during WrestleMania 32 weekend. It’s still altogether possible Big E was correct in what he said about New Day’s sales that weekend but that the stable wasn’t in fact among the top ten merchandise sellers throughout the year.

Searches for the NXT brand itself outdid most of the wrestlers on the main roster.

Kane and Kalisto ranked unexpectedly high, possible due to mask-related merchandise, to take a wild guess. There’s currently very little Kane merchandise listed on WWEShop. I couldn’t even find Kalisto merchandise of any kind on the site. While this study gives us some good general clues, counterintuitive rankings like those of Kane and Kalisto are probably suggestions that taking this ranking at face value wholesale doesn’t give a fully accurate depiction of who moves merchandise. Cena and Reigns being the decisive leaders, for example, likely reflects the reality of actual sales given the wide margin by which they lead the others for searches.

Notice the increases in the latter quarters of for the likes of Finn Balor and Goldberg, which coincides intuitively with their appearance on main roster WWE television in the latter part of the year. Balor’s searches also held up well in Q4 despite being injured and not appearing on TV after late August.

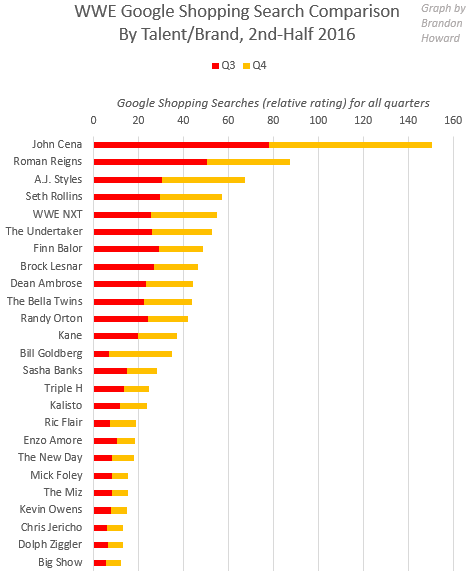

If we look just the last half of the year, after the RAW/SmackDown brand split began on July 19, the ranking is as follows:

Goldberg who returned to WWE TV in November, would rise to #5 if we isolated only Q4.

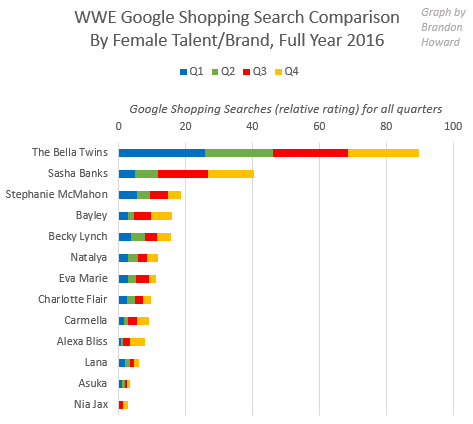

Looking strictly at female talents, the Bella Twins top the rest for shopping searches by a wide margin despite not being one of the eight featured on the WWEShop menu. Sasha Banks however, who is featured in the menu, comes in at #2. She did especially well in the latter half of the year. Charlotte, who’s arguably been WWE’s most pushed female wrestler, ranks below Bayley, Becky Lynch, Natalya and even Eva Marie. That fact could be attributable to Charlotte being a heel and perhaps Natayla and Marie having longer tenures on the main roster as well as being featured, like the Bella Twins, on the Total Divas reality show.

Bayley who debuted on RAW on the night after Summerslam, on August 22, saw significant increases in searches during Q3 (July to September) and Q4 (October to December) compared to the first half of the year. Predictably, like Balor, saw significant increases in shopping searches after their main roster debuts, demonstrating the power of being on WWE’s largest television platforms compared to when they were top stars in NXT.

If we isolate Q4, Alexa Bliss, who debuted on the main roster after the July brand split and went on to win the SmackDown Women’s Title, jumps to #4 in this ranking.