WWE Q2 Analysis: Vince McMahon calls AEW “blood and guts”, Wrestlemania’s paid attendance, most metrics still declining

Huge TV rights fees and deals with Saudi Arabia keep WWE financially strong, even as other metrics decline.

WWE CEO Vince McMahon took the opportunity to frame All Elite Wrestling as an overly violent “blood and guts” wrestling company during his company’s Q2 earnings conference call on Thursday.

“As far as our competition is concerned, the old adage is that competition is good for everyone,” McMahon said during the Q&A session, apparently talking about AEW.

“I think that’s generally the case, although again we’re hoping that — to the extent that they are competition — we’re hoping that they don’t go on with blood and guts and gory things that they have been doing, which would be bad.”

“And I can’t imagine — I can’t speak for TNT,” McMahon continued, mentioning the TV network that AEW will debut on in October, “but I can’t imagine they’d put up with that.

On a day where WWE gave updates on its lucrative deal with the Saudi Arabian government and on declines in WWE Network subscribers, live event attendance and merchandise sales, McMahon indirectly referred to AEW on two separate occasions during the call, referring to the new company as “competition”. Earlier in the call, he discussed Raw and Smackdown becoming “edgier” shows.

“We’re going to be a bit edgier, but still remain in the PG environment. We haven’t come anywhere close, actually, to going into another level, so that’ll be something we do in terms of direction of content: more controversy, better storylines, etcetera. But at the same time we’re not gonna go back to the ‘Attitude Era’, we’re not gonna go back to the blood and guts and things of that nature such as [is] being done perhaps [by] a new potential competitor.”

Perhaps suggesting his company is more advertiser-friendly than the new competitor, McMahon went on: “We’re just not going to go back to that gory crap that we graduated from. And again, a more sophisticated product, again, attracting much better writers, attracting better management and things of that nature.”

Has WWE popularity turned the corner?

“We have definitely turned the corner,” McMahon said in response to an analyst question about the state of WWE product, storylines and key metrics, which the CEO said in the Q1 call were suffering due to the absence of talent that a Variety article showed largely returned in Q2.

McMahon noted the recent hires of Eric Bischoff and Paul Heyman as executive directors to work on Smackdown and Raw, respectively.

“It allows me to look at a longer-range story arc standpoint, and also spend more time on talent development, and not get into the weeds as much as I had to do in the past.”

WWE Investor Presentation (Jul 25, 2019)

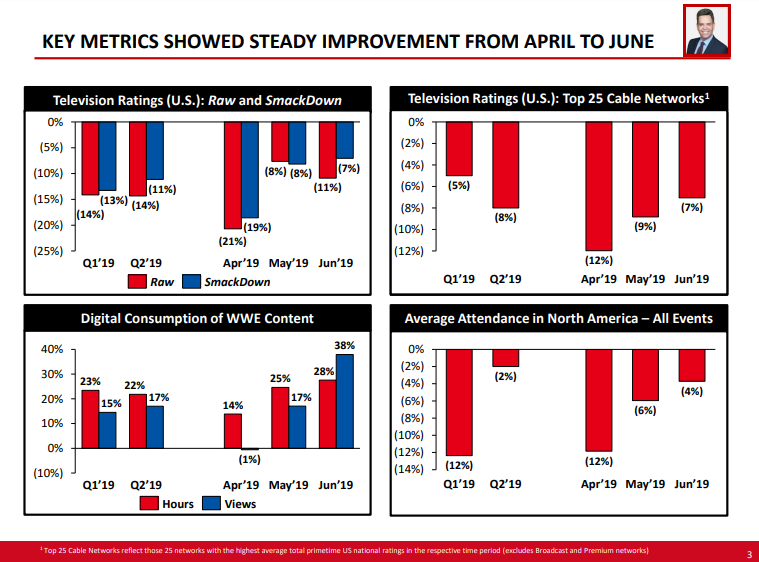

WWE Co-President George Barrios showed a slide during the call breaking down some metrics by month, a level of detail the company usually doesn’t provide. For monthly comparisons, declines in TV ratings and attendance slowed during Q2, and digital consumption of online video increased. That is to say, TV ratings and attendance in June 2019 were down from June 2018, but not as badly as April 2019 declined compared to April 2018.

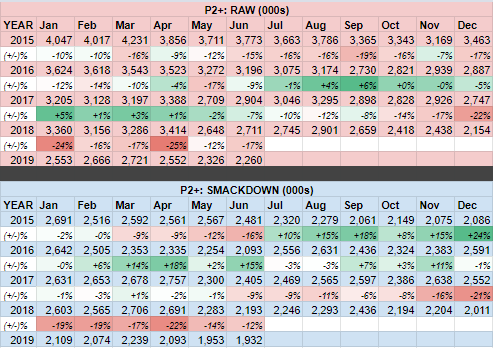

Viewership data compiled from Showbuzzdaily shows strong declines than the TV ratings declines WWE shows in the slide above. Although P2+ viewership is a different metric than the TV ratings WWE reported, P2+ declines for Raw were down more strongly in June on a monthly comparison than May.

At another point in the call, an analyst questioned about whether hiring new writers was the investment needed to repair ratings and other metrics.

McMahon answered: “Yes, bringing in new faces, new blood who have different kinds of ideas and connections and so forth– again, it’s just not one man’s vision. It’s now a combination of what will happen in the future. So again I’m bullish on all of that. When you look at not just television ratings but metrics from social and digital [media] and what have you– that really is the new way of promoting, notwithstanding the fact that we are going to continue to build the motherships, as it were, Raw and Smackdown. So again from an investment standpoint that’s where you should obviously invest your dollar, but it’s not [a] sizable [investment] at all.”

Finances

WWE was profitable during the quarter that contained Wrestlemania, covering the period from April 1 to June 30, 2019. Operating income for Q2 was $17.1 million (down from $21.2 million in Q2 2018) and net income $10.4 million (slightly up from $10.0 million). Revenue for the quarter was $268.9 million, down 5% from Q2 2018 due to revenue declines in most areas of business, including WWE Network, merchandise sales and international ticket sales.

Despite the decline in revenue for Q2 and an unprofitable Q1, the company is strong financially, largely due to enormous TV rights fees for Raw and Smackdown. The company affirmed its expectations to set new records with $1 billion in revenue and $200 million in its preferred profit metric, adjusted OIBDA (operating income before depreciation and amortization), hauled on by upgraded TV rights deals in the U.S. that begin in October and agreements with Saudi Arabia’s General Sports Authority.

The stock market responded well to the report. WWE’s share value has fallen in the last few months since its all-time peak at $100 per share in April. The stock price closed the day at $74.68, up 9% on the day.

WWE & Saudi Arabia

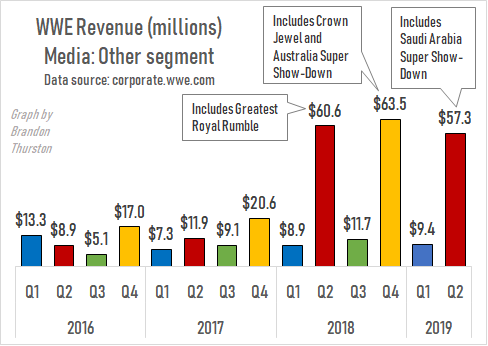

Like the major Saudi Arabia events last year, Super Show-Down on June 7 appears to have been worth tens-of-millions of dollars in revenue to WWE, despite the associated controversy.

Even more Saudi money may be on the way in the form of media rights deal WWE gave limited details on.

WWE’s partnership with OSN Sports to broadcast its programming in the Middle East recently ended. Possibly replacing that deal, WWE stated it has an agreement “in principle” with the Saudi government for a new media rights deal, but that the deal is dependent on “improved engagement”. If the deals are not completed as expected, it could affect WWE’s aforementioned record revenue and adjusted OIBDA projections.

The earnings press release makes such a media deal and the expected live event in Saudi Arabia in November sound like they’re in expected to be finalized but are in question, depending on “engagement metrics”:

This guidance assumes continued improvement in WWE’s engagement metrics, a second large scale event in the MENA region, and the completion of a media rights deal in the MENA region. The Company believes it has agreements in principle with the Saudi General Sports Authority on the broad terms for the latter two items; however, this understanding is nonbinding. It is possible that either or both of these business developments do not occur on expected terms and/or that engagement does not improve as assumed. The Company has evaluated these potential outcomes and currently believes that the most likely downside to its Adjusted OIBDA would be approximately $10 million to $20 million below its current outlook.

WWE Network: new platform, better search, more tiers, more languages, fewer subscribers

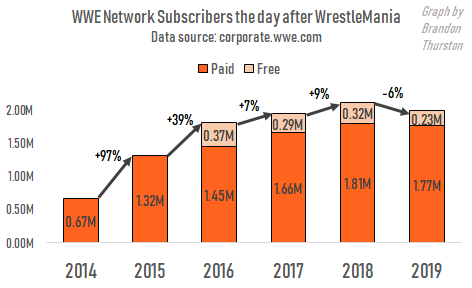

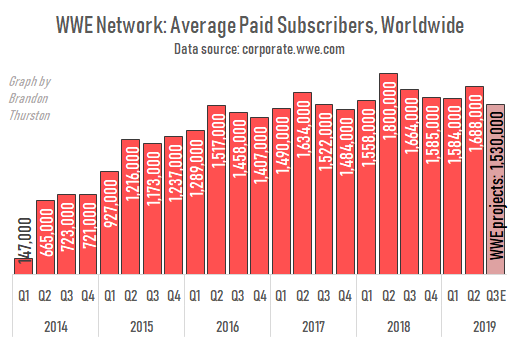

WWE Network subscribers were down compared to the same quarter of the prior year for the first time in the history of the service, as the company projected in the previous report. Paid subscribers over the quarter averaged 1,688,000, down 6% from Q2 2018’s number (1,800,000). This comes off the news from the previous quarter that the day-after-Wrestlemania subscriber count this year (2,000,000 total; 1,808,000 paid) was also down 6% from last year’s (2,124,000 total; 1,767,000 paid).

Q3 doesn’t look any better. WWE projects an 8% decline for that quarter, with average paid subscribers at 1,530,000 (down from 1,664,000 in Q3 2018).

Despite subscribers declining, the WWE Network is being revamped under new platform backbone Endeavor Streaming Group. WWE announced on Wednesday the platform will be updated to include improves to the interface and search function. Thursday’s release confirmed the addition of free and premium tiers, as well as localized languages for the service. Barrios noted during the conference call that the new tiers and languages would be rolled out within the next 12 months, with the free tier being introduced first, followed by the premium tier second and new languages after that.

Live event business, Wrestlemania 35’s paid attendance

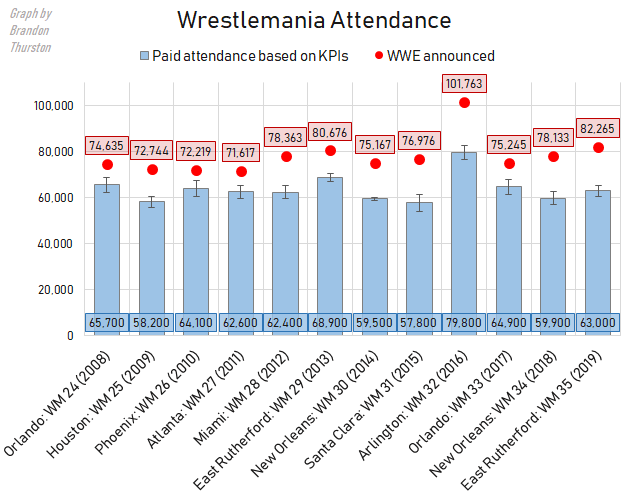

Paid attendance for Wrestlemania 35 was about 63,000; at least 60,399; at most 65,547.

Whether the 82,265 WWE announced as the attendance for Wrestlemania 35 in East Rutherford, NJ, includes free attendees and event staff or whether it’s just a made up number is unknown. Based on attendance averages WWE publishes each year, including and excluding Wrestlemania, in its Key Performance Indicators document, we can deduce a range for the paid attendance for the big event.

The public live gate for the event, $16.9 million, the second-biggest pro-wrestling gate of all-time (behind Wrestlemania 32 in 2016), isn’t in question. This puts the average ticket price for Wrestlemania 35 at about $268, give or take $12. Unsurprisingly, that’s the highest ever, up from the estimated Wrestlemania ticket price last year of $235 (+/- $13).

Thanks largely to Wrestlemania, the Live Events division was profitable in Q2 which has been a challenge in recent quarters. Still, operating income for the Wrestlemania quarter, this year $12.4 million, is on the decline since 2016.

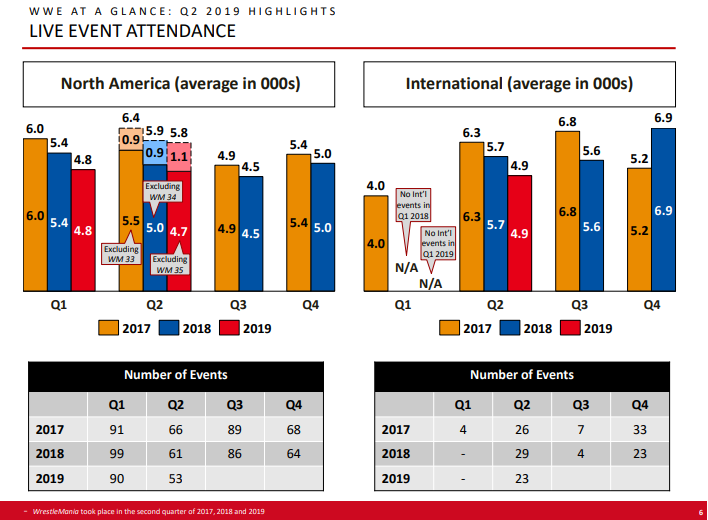

The decline in Q2 was due largely to a decline in international ticket sales. WWE’s events outside North America in Q2 generated $9.5 million in revenue, down from $13.5 million Q2 2018 and $12.4 million in Q2 2017.

WWE Key Performance Indicators (Jul 25, 2019)

Excluding Wrestlemania, North American attendance was down also, with an average of 4,700 tickets sold on main roster events for the quarter. This was the sixth-consecutive quarter North American average attendance declined in quarterly comparisons.

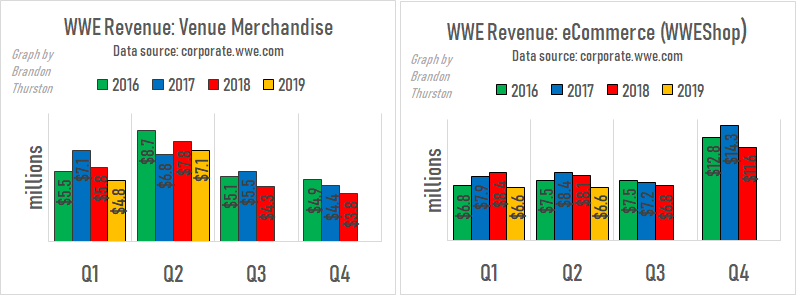

Merchandise sales decline at venues and online

With attendance down, merchandise sales at live events were down too, despite the per capita spending increasing from $10.42 in Q2 2018 to $12.62 in Q2 2019.

There were fewer orders on WWE’s online eCommerce platforms as well in Q2 (138,125; versus 182,000 in Q2 2018).

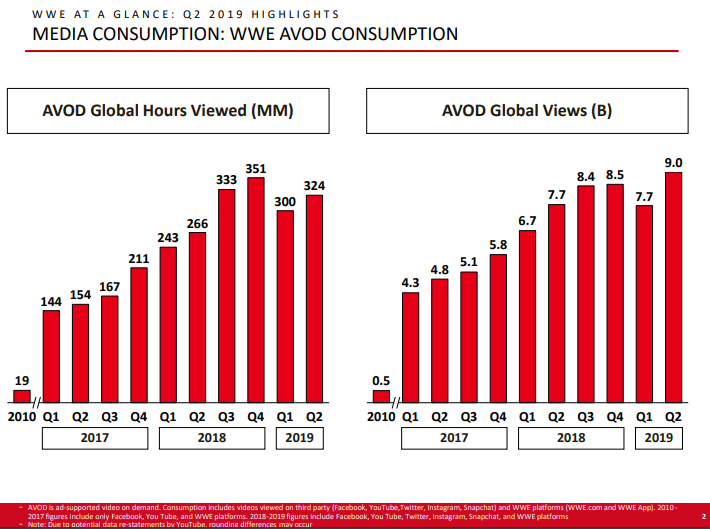

Online video viewing recovers

WWE Key Performance Indicators (Jul 25, 2019)

After a surprising dip in Q1 in video views on platforms like YouTube, Facebook and Instagram, online video activity was back up in Q2. A new record 9 billion views were reported, producing 324 million hours of viewing time. It’s believed these video views generate a relative small percentage of WWE’s revenue, mostly via YouTube.

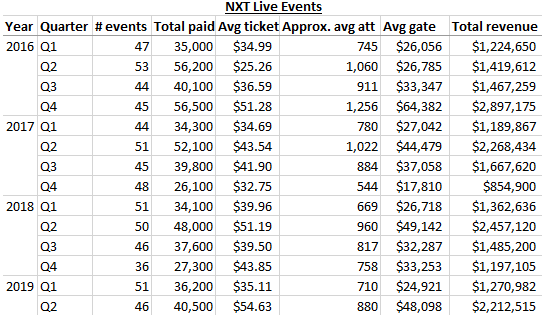

NXT attendance

NXT attendance is reported separately from main roster attendance. Q2 total attendance (40,500) and average attendance (approximately 880) was down from Q2 2018’s numbers of 48,000 and 960, respectively. Revenue generated from the events was more comparably due to an increase in ticket prices.

Brandon has been writing about the wrestling business since 2015. He’s an independent pro wrestler, wrestling trainer, and co-host of the podcast Wrestlenomics Radio. Follow him on Twitter @BrandonThurston.